A premier-income earner is typically recognized as an individual who brings in more double the average home money.That it tolerance can differ with regards to the cost of living in a specific town, nevertheless fundamentally falls anywhere between $100,000 and you can $2 hundred,000 per year. High-income earners are usually able to manage items that is away of take we, for example expensive land, deluxe vehicles, and unique vacations. They could also provide usage of greatest employment opportunities and higher amounts of work defense.Higher-money always is sold with high cost of living due to existence options loans Winfield AL. They may also provide so much more taxable money that lower the need-domestic pay. Ergo, it too might need to borrow funds sporadically.In the event the large-income earners possess lots of loans or a minimal borrowing from the bank score, they might be unable to see capital, aside from its money.

What is actually an effective yearly income?

In terms of individual funds, there’s no you to definitely-size-fits-all of the solution to the question out-of just what comprises an effective annual earnings. not, there are many general assistance that will help determine if for example the income is sufficient to meet your needs. First, your annual earnings would be sufficient to cover each one of your own important expenditures, such homes, dining, transport, and you will healthcare. Also, it should make you with enough money to cover unexpected will set you back, such as for instance medical expenses or auto fixes. Finally, you have particular throwaway income left-over each month to help you rescue for upcoming wants otherwise take pleasure in relaxation activities. Ultimately, the degree of income you should real time a smooth existence are different based on a points. Additionally, it may trust where you live. Certain states on the large cost-of-living become The state, Ny, and you will Ca. What is actually thought an excellent income various other states may possibly not be sufficient to inhabit a state with high price of life style.

Does higher money raise credit history?

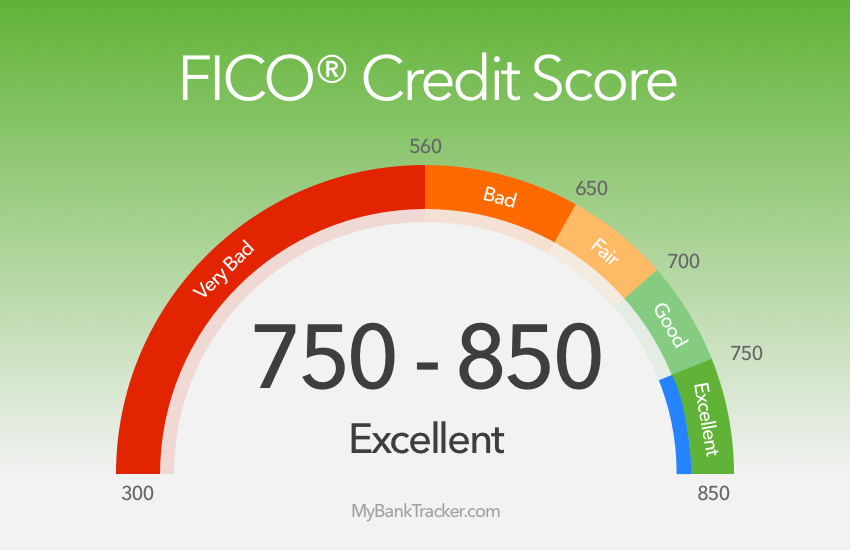

Which have large earnings, you will have a simpler day spending expense, which should change your credit rating. But not, money is not myself linked to credit history. Lenders looks from the income as an ensuring grounds for how far capable mortgage just in case you qualify, but credit score comes with the really impact. Loan providers have a tendency to consider credit history, utilization, length of credit rating, and money, along with credit score.

While we stated, earnings does not influence credit history. When you have less than perfect credit but strong otherwise highest income, this should help you be eligible for financing. But not, you might have to explore a guaranteed loan instead. For those who have poor credit, you will want to begin by examining your credit history. Select one areas of update and attempt to improve your borrowing from the bank score before you apply. You can access a totally free content of your credit file shortly after a year from one of your own three big credit agencies. It’s a good idea observe their borrowing on a routine basis. One of the recommended a way to do this has been a totally free credit keeping track of system instance Borrowing Karma.Another way to improve the likelihood of approval is by using that have a cosigner. The cosigner need good credit or finest credit than you preferably.Extremely loan providers possess a minimum credit rating requirements. You can check about this needs to be sure during the good minimal your see it before applying. AtAcorn Financeyou is also examine unsecured loan now offers. Some of the financing partners features minimal credit score criteria since lowest due to the fact 560.

Can you become approved for a financial loan on account of large earnings?

A lot of people accept that the only method to become approved to have financing is always to has actually a top earnings.While it is true that that have a high income can be replace your odds of being approved for a loan, there are other points one to lenders will envision too. Your credit rating, employment records, and obligations-to-earnings proportion are common important factors that loan providers is also thought whenever determining whether to accept financing. Very lenders play with credit rating as biggest determinant, even when money is essential also. You’ll need to have the ability to pay and that’s where a high earnings might help out.