When you yourself have an extra space in the house, you may want to convert it towards a workplace. You’ll want to purchase furniture and you will want to color the newest wall space, incorporate compatible lighting, and you may set-up the fresh floor. Particular budget-amicable home business office info could make the recovery economical.

Exterior/Rooftop

Of a lot people change the rooftop when it provides problems such as for example leaks or rotting. But not, when your rooftop is more than two decades old and you will reveals signs and symptoms of don, it’s likely smart to consider replacement they soon to avoid upcoming issues. Thankfully, it is possible to funds yet another roof .

The style of your home also can change the average rates in order to reple, if you very own an adult house when you look at the a historic region, you might have to pursue particular ordinances or recommendations after you renovate which will need playing with pricier content. Assuming you reside perhaps not a standard figure, features an elaborate framework, renovations could also be costlier. And you may, without a doubt, the bigger your home, the greater number of you can easily typically pay in order to remodel they.

Updates

The condition of your house will assist influence the root will cost you of your own recovery enterprise. The new elderly your home is, the more install it may need, that may create most framework can cost you. Big-ticket items like installing central air conditioning, dressed in an alternate rooftop, and you will substitution window is also drive within the speed.

Location

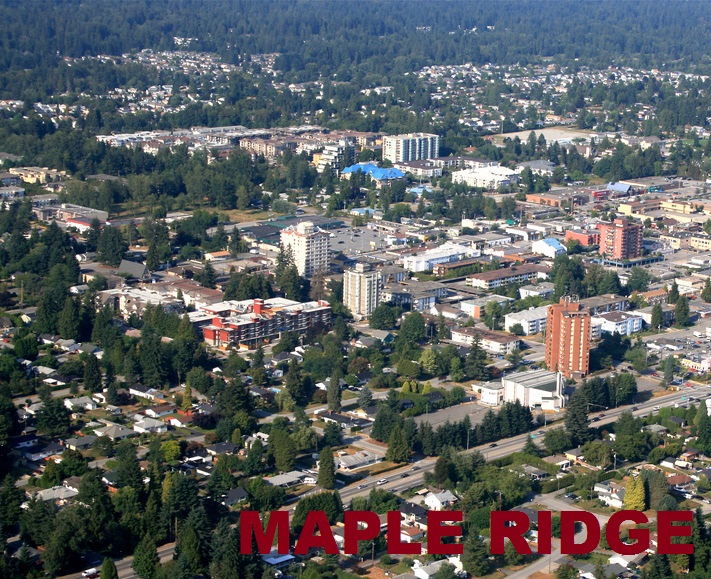

The spot of the nation you live in also will factor toward average cost to help you upgrade a home. By way of example, remodeling a home into the a massive urban area can cost doing 40 per cent more remodeling a property within the a rural town.

Procedure

Your financial budget you are going to influence the material you select for your house repair systems. Alternatives such top-of-the-line counter tops, advanced equipment, and you will large-end accessories often push in the cost of your project. not, they also you will enhance the selling property value your home later on, therefore consider the pros and you can drawbacks before generally making one larger monetary decisions.

Labor

Work costs can be fluctuate significantly based on your area and you can exactly how thorough the project is. For those who have a labour-intensive work particularly removing a classic roof in advance of incorporating a new that, like, the entire price was large. One way to keep the cost in order to remodel a house within a variety you really can afford is to imagine doing a bit of off the smaller tactics yourself.

Permits

Permits getting high renovation strategies can cost anywhere between $eight hundred and you will $1,800. Speak to your municipal place of work regarding it permits that may be required for assembling your project to ensure that you rating that which you you want.

Resource Options for Renovating a property

If you are looking for the funding your renovation, you’re offered property equity personal line of credit, or taking out a profit-out refinance otherwise unsecured loan in order to remodel your property . Some tips about what to learn about for every single alternative.

HELOC

A house equity credit line (HELOC) allows you to borrow on your own home’s equity to an accepted maximum. The interest rate is actually changeable. As opposed to finding a lump sum payment, you might borrow HELOC fund as required during what’s called the draw several months, and that generally lasts around a decade. When the draw period stops, the new fees period begins, that’s as many as three decades. However, keep in mind that if you cannot repay everything you owe, the lender you can expect to foreclose on your own house.

Cash-aside Refinance

A cash-aside refinance allows you to refinance their mortgage if you’re credit currency meanwhile, in line with the collateral you’ve got of your house. The bucks-out re-finance procedure requires borrowing a separate mortgage to own a much bigger amount as compared to current financial; you then have the difference in cash for the renovation. Loan providers will limit dollars-out refinances to 80 % of your security a borrower has actually in their house. You can shell out closing costs and you can should have your family appraised.