When you have currently called their bank to see exactly what the criteria try to possess a company loan, you may have currently found the amount of records is almost certainly not for your needs for your situation. Because of every red-tape banking institutions have observed specific of its website subscribers trying to find alternative choices into business loans. Faster paperwork grew to become a more a normal practice from inside the non-traditional business loans, almost concise where it seems these lenders could well be also easy.

Strike because the iron’s sizzling hot!

Before banking crisis regarding 2008, banking institutions have been composing fund so you can anyone that you will fog a good echo. Subprime lending and Alt-A software caused it to be easy to be eligible for a house loan, just about anyone may become a resident. Depending on the time, some individuals most benefited from all of these version of software, they could and acquire multiple qualities and you will either flipped them for huge profits or remaining all of them for their collection. Although trick right here is actually their time, they got benefit of this new programs that were to and then that those software aren’t available any more it’s harder to find characteristics while making money. Choice business financing was as much as so long as the newest fund that will be financed are performing. In place of the borrowed funds crisis where this type of money come to standard, financial institutions had to end money around the individuals variables.

Protecting a business Financing with just minimal or no Paperwork

Of many lenders normally demand consumers to do an array of models, nearby bank comments, investment verification, tax returns, harmony sheets, earnings recognition, and a lot more. Whenever you are an extensive paperwork processes could offer experts, additionally confirm excessively date-ingesting. Antique banks, known for its slow pace, will get-off consumers awaiting working-capital for longer periods.

Luckily one to small enterprises have the fresh new choice to obtain finance with just minimal to no records conditions. Initially Investment Team Funds, i get rid of the significance of too-much financial statement articles to help you lenders. We’ve enhanced new resource procedure to have ease and efficiency.

Recognizing one small enterprises lead busy lifetime, the lower-files funds can handle speed, letting you allocate some time where they matters really.

Based who you want to go with, all of them provides different requirements. But the most frequent factors needed whenever trying to get an operating capital financing:

- three to six months financial statements of all providers bank accounts for the most previous weeks

- three to four weeks bank card control comments for recent weeks for individuals who providers procedure playing cards

- Application (this will be anywhere from 1 to 2 profiles, but very basic suggestions)

Rarely do you look for lenders requesting tax returns otherwise financials, yet not it’s not strange toward big financing amounts. The things mentioned above would be adequate to allow you to get a keen respond to if they offer you a business mortgage. Turn around times discover an answer is sometimes contained in this 24 days, in case your financial/representative youre handling is actually bringing more than a couple of days you might want to reconsider that thought exactly who you’re using the services of. If you agree to new words you can have loan files within a similar day, as well as the period the financial institution will be asking for extra issues.

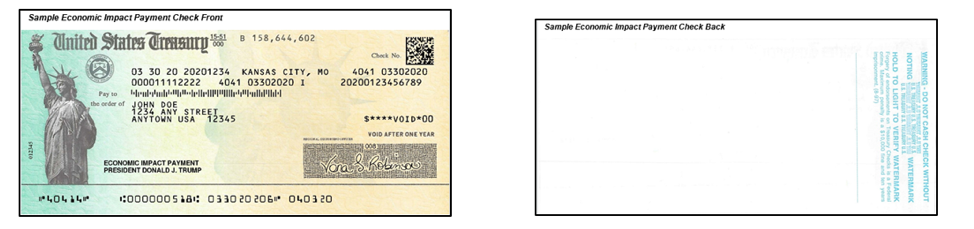

- Nullified examine from the providers savings account for them to wire the amount of money

- Backup regarding Vehicle operators Permit otherwise Passport to show you are the business owner(s)

- Sometimes they will want to manage a site inspection of the organization to make they feel a tad bit more comfortable with the fresh new mortgage.

- Backup out of nullified rental find out if your enterprise is renting it’s area, if you have a home loan they will want to see the newest mortgage declaration appearing you are current.

- Verbal confirmation to the entrepreneur together with funding origin, they will discuss the borrowed funds words on the entrepreneur again to be certain they fully understand them.

We hope which will give you a surgery loans review good idea on which would be required whenever trying to get a low-old-fashioned providers financing. Discover an excellent website who may have a great deal of details about loans, here are a few united states away to find out more throughout the providers resource. Naturally we have all an alternate circumstances plus state was a small other, if you like for more information feel free to cam that have our team advancement executives. They’re attained at 888-565-6692 .