First-time buyers might possibly be offered 100 per cent mortgage loans because of the UK’s most significant lender because the latest put-free mortgage strikes the business.

Lloyds Bank’s Lend a hand financial allows very first-day buyers in England and Wales to buy a house charging to ?500,000 as opposed to in initial deposit.

The brand new mortgage covers between 95 and you may 100 per cent of the purchase price regarding a first house. not, people will require a relative having good coupons to help you stump right up 10 percent of the property price while the cover in order to gain access to this new 100 % financial.

This currency goes towards an excellent around three-12 months repaired-label family savings generating dos.5 % appeal, that’s reduced at the conclusion of the definition of however, cannot be utilized just before you to definitely. In the event your buyer misses one mortgage payments these types of might possibly be subtracted regarding deals.

On average first-go out buyer today placing off a deposit out-of ?110,182 during the London area and you can ?33,211 regarding remaining portion of the nation, increasing a lump sum payment is one of the most significant obstacles to help you bringing towards possessions hierarchy.

First-time customers all you have to learn when purchasing the first home

According to an excellent Lloyds poll, half ambitious first-date buyers said raising a deposit was the greatest obstacle when trying to get a home.

Normally, 18-35 season olds try preserving ? 30 days, definition it could need them 15 years to save having an effective put, or 52 ages inside the London.

„The product is actually assisting to address the biggest challenge first-date customers face of having about the possessions steps, when you find yourself rewarding loyal customers into the a reduced-price environment,” said Vim Maru, class movie director, merchandising in the Lloyds Financial Category.

The way the Help home loan really works

The fresh new Help financial is the most recent finest pick to possess one another consumers and you can savers. Its fixed at dos.99 % notice for three decades, that’s 0.step 1 percent lower than new similarly structured Household members Springboard home loan away from Barclays.

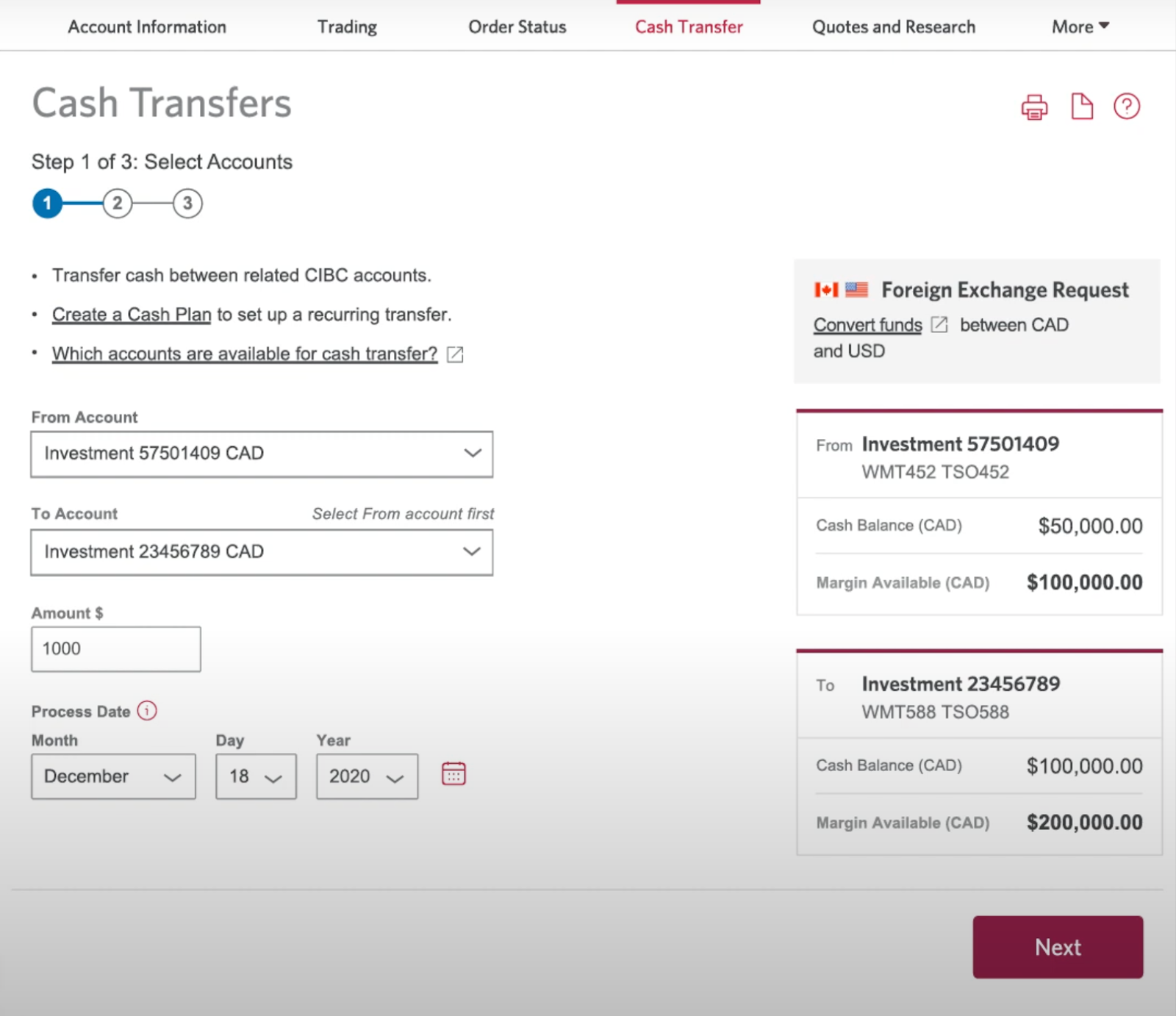

- Domestic rate: ?425,030

- Monthly payments on around three-year fixed speed from 2.99 percent: ?2,

- Monthly obligations to the Lloyds important changeable rate out of 4.24 per cent once three years: +? = ?2, (getting remaining twenty-two years)

Both.5 % deals rate into Lloyds home loan is some higher than the new Barclays you to definitely, that’s certain to end up being step 1.5 percent above bank ft speed for three many years. Already you to definitely establishes the new Barclays offers attract during the dos.twenty five percent, even though this you’ll rise otherwise slide dependent on what will happen so you can rates of interest.

The newest Barclays Nearest and dearest Springboard home loan is served by a maximum term off 25 years, as Lloyds mortgage would be taken having 31, making month-to-month costs straight down – even though this do enhance the overall number of notice reduced over the class of home loan.

Unlike almost every other comparable schemes, the fresh Lloyds mortgage is fairly versatile on what members of the family can contribute first-go out buyers can get help from its college students, sisters, grandparents otherwise aunts and you can uncles.

Often the consumer or family member need to be a bar Lloyds Most recent Membership owner, which has an effective ?step three monthly fee, unless of course ?step one,five hundred try paid-in each month.

What’s the catch?

What '100 per cent mortgage’ is actually bound to ring alarm bells for a few people, apprehensive about a get back to the sort of financing seen through the that point leading up to the new financial crash.

The newest the websites product is not quite a re also-run of your 100 per cent-including loans offered when you look at the 2008, considering the importance of the latest ten percent lump sum so you can support it. However, you can find factors people is always to keep in mind prior to taking out such as for example a massive loan, especially in the modern property id Brexit-uncertainty.

Home costs are prediction to stay broadly flat along side next three years and to fall-in London this season.

If the house pricing remain at its latest top, customers taking on this 31-seasons home loan tend to nevertheless need an effective 93.5 percent financing to help you worthy of mortgage in the event that about three-year repaired title are right up inside the 2022, states Andrew Hagger regarding .

In case your relative chooses to take back the 10 for every cent to date it can be burdensome for the consumer in order to remortgage, pushing the customer on the Lloyds practical adjustable price.

„Just what remains to be viewed are the options available in order to consumers in the event the three year repaired rate possess expired. Being left that have instance a premier loan in order to worth contribution is to create individuals in order to re also-financial somewhere else in the event alternatives are going to be very minimal,” claims Colin Payne, representative movie director out-of Chapelgate Private Money.

„Presently, a debtor looking to re also-mortgage at this mortgage to help you well worth might be offered equivalent pricing in order to Lloyds Bank’s three year fixed price of 2.99 percent.

„Lloyds Lender is served by said it does provide choices to consumers in the event the fixed price expires, but not, this type of tend to clearly be according to research by the financing so you’re able to value during the the time incase possessions beliefs has actually fell the newest rates on the promote is actually unrealistic getting once the attractive as brand-new terminology.”

In a poor case circumstance, if the home cost fall-in next three years – not impossible considering the newest number of Brexit uncertainty – then customers may end up in negative collateral, struggling to remortgage or flow and you can trapped towards Lloyds’ fundamental changeable rates.

This means they can enjoy the stamp responsibility reductions offered to help you very first-go out consumers, which is not you can easily if someone else who may have previously owned an effective property have their label with the deeds too eg if to purchase together which have a dad who owns their own house.

Subscribe our very own neighborhood where you could: discuss stories; join updates; get into tournaments and you may accessibility content to the the app.