Addition

Which have a beneficial Va loan being among the most common choice for productive and you will low active service dudes / women, the obvious the advantages they located are worthy of it regarding getting a home loan. Owing to all the way down interest rates, no advance payment requisite as well as no financial insurance, their easy to see why. However, virtual assistant minimum credit history criteria with regards to virtual assistant mortgage can differ out-of lender so you can financial and you’ll need certainly to discover their overlays.

An essential key function whenever applying for a virtual assistant mortgage was minimal credit score. New Virtual assistant place of work doesn’t present people lowest get on their own. Lenders often measure the risk of the newest borrower according to research by the AUS (automated underwriting app) conclusions. This, gives the possible opportunity to believe various points near to borrowing from the bank like casing/local rental records, borrowing application and just how much a lot more bucks you’ve got for the supplies.

The latest Virtual assistant alone does not really provide currency. Instead, it offers a partial be certain that for fund you to meet the standards. Instead of most other financing items, the fresh Virtual assistant cannot enforce a strict minimal credit score requisite within their assistance. Yet not, good virtual assistant lender whom offers Va mortgages have the flexibility to introduce their particular credit score conditions.

They measure the creditworthiness off people to discover their particular lowest credit history tolerance. This flexibility enables lenders to look at additional factors close to credit ratings, ultimately causing more individuals being qualified to own Va loans.

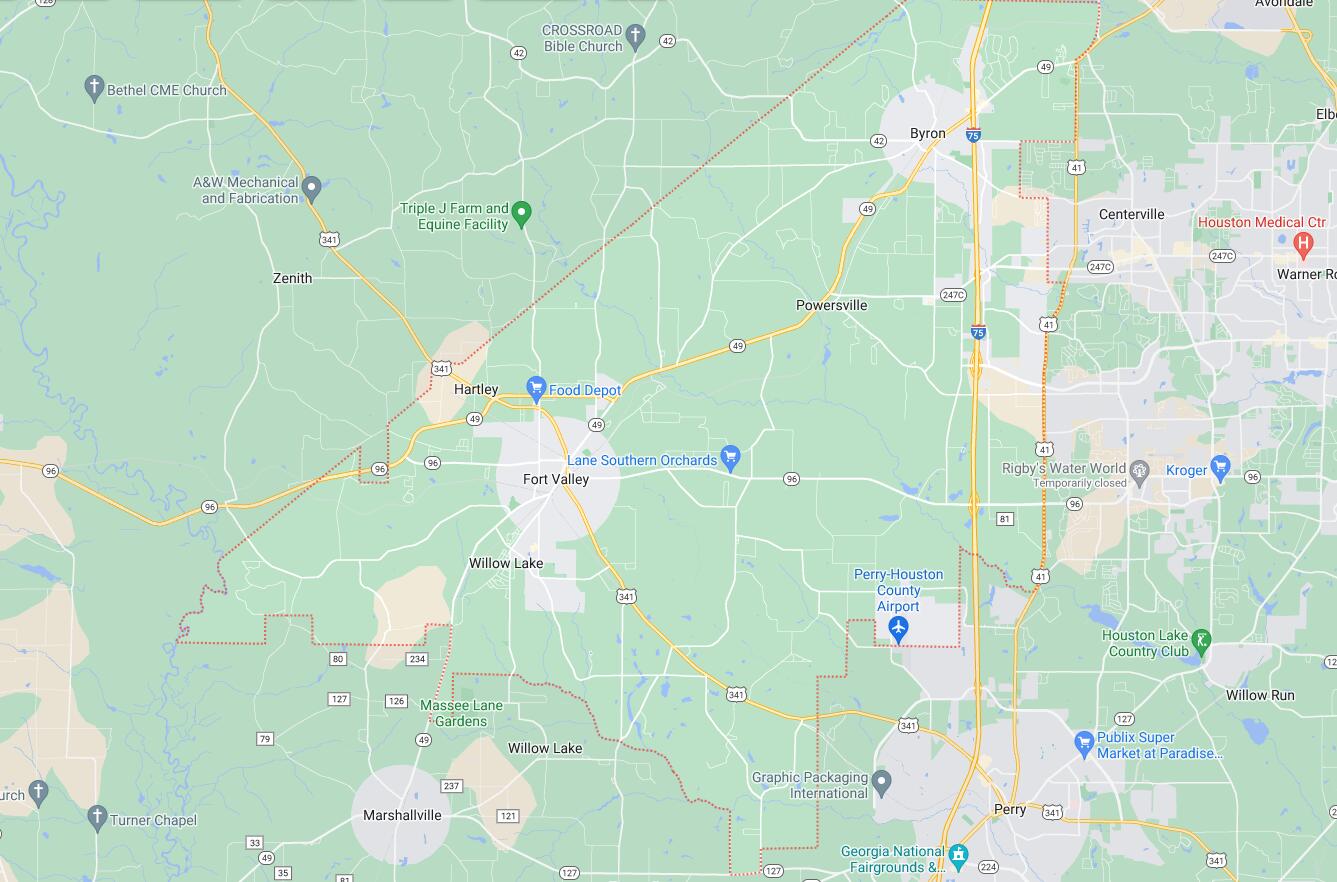

In order to train exactly how loan providers approach credit history criteria getting Va loans, we are able to look at the instance of South Texas Credit , a leading mortgage lender. While STX Credit pursue its advice, it functions as an illustration to assist borrowers know how lenders assess credit scores getting Virtual assistant loans. Familiarizing your self that have instance advice can give you knowledge to the eligibility standards and requirements to have getting a Virtual assistant loan.

Who will Use a good Va Mortgage?

A great va mortgage verify are only able to be somebody that is for the otherwise earnestly a qualified services member, veteran and you can/or enduring partner. Getting qualified to receive an excellent virtual assistant financing, really va loan providers will have all of them meet the prerequisites. Mortgage lenders generally find respectable discharges if or not already offering otherwise non-productive. The newest surviving companion off an army teams can occasionally get moved the newest certification off qualifications.

Taking a good COE directly from the Virtual assistant workplace is actually a necessary step in qualifying to possess good va mortgage and sometimes complete throughout the the program processes. This new COE serves as proof of qualifications and confirms you to an enthusiastic private fits the necessary standards to make use of the advantages of a great Virtual assistant financing. While solution date standards are usually needed, surviving partners and people released on account of injury could be excused from these particular conditions.

If you have not yet acquired its COE, STX financing will bring guidance in protecting it important document. The educated people normally publication individuals from the procedure of getting the brand new COE, making sure they meet with the called for standards so you’re able to qualify for an effective Virtual assistant loan.

What Experts Come with good Va Mortgage?

There are several fantastic pros that are included with getting a good va home loan. The largest is not being forced to place a downpayment upon you buy. Yup, you got that right! Other loans less than 20% down have a tendency to called for you to definitely bring PMI otherwise MIP. The fresh new savings away from MI try deals you realize every month.

Second, was interest levels. Va funds offer some of the finest interest rates available to choose from. Which have an excellent Virtual assistant loan, you may enjoy down rates compared to the other financing possibilities. Its such bringing another type of offer for only becoming an assistance associate or experienced. A huge reason new cost function better is mainly because it was much safer getting traders and you will secondary investment locations. How? Once the Virtual assistant pledges a installment loans no credit check Victoria KS portion of the amount borrowed , as much as twenty-five% if however you standard on the mortgage.